Retrospective Valuation: What is it?

A retrospective valuation, sometimes referred to as a back-dated property valuation, determines the value of the property at a certain point in the past. A retrospective property valuation report is most frequently used as a basis for determining a property investor's capital gains tax obligations.

For Capital Gains Tax

Property investors must provide a capital gains tax valuation report to the Australian Tax Office (ATO) in order to determine any capital gains they may have realised from the sale of their investment property.

It may be necessary to conduct a back-dated valuation for CGT purposes if you're not sure whether the price in the original sale agreement was an accurate valuation, as your capital gains tax obligations will depend on the property's increase in value from the time it was first purchased or used as an investment property to the time it is being sold.

Back-Dated Valuation for other situations

However, there are other situations that could potentially compel you to have a back-dated valuation report, such as:

In each of the aforementioned situations it is essential to obtain a valuation based on a date in the past from a qualified, experienced and skilled property valuer, since a retrospective valuation has a substantial impact on a person's tax liability.

How is a Retrospective Valuation carried out by property valuers?

A property valuer will need to conduct both a physical inspection and research and analysis of historical data in order to complete a retrospective property valuation report.

Analysis of data relevant to the Retrospective Date of Valuation

A database with historical market value information accessed by an experienced property valuer can provide the experienced valuer insights about the market conditions at the retrospective date of valuation and the months before that.

Since property prices fluctuate frequently, property valuers typically conduct significant market research throughout this period. The current sale price and the backdated property valuation may both be greatly impacted by these changes.

The following are generally taken into account by a property valuer when conducting the retrospective valuation property report:

<More>

Physical inspection required

The property valuer can gather significant evidence during a physical inspection in order to produce an accurate property valuation. Physical inspections can significantly affect the property's overall value because a property valuer will typically note:

Although it is not always necessary, a physical inspection gives the property valuer a clearer picture of issues that could otherwise be missed.

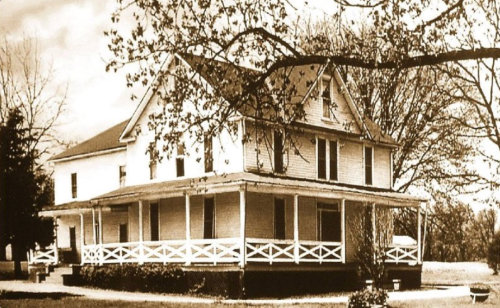

However, if a required valuation is very far back in time, the current state of the property during the physical inspection might be very much different from its state at the retrospective valuation date. In such cases, the valuer may complement the physical inspection with old photographs, old floorplans, back-dated aerial images and information from the client to arrive at more accurate picture of the property at the retrospective valuation date.

Why appoint AskTheValuer for your Retrospective Valuation?

The goal is to ensure that you are not paying a cent more in capital gains tax than necessary or getting a cent less than your rightful share in a property settlement. And it will be carried out for you at a reasonable fee.

The valuation will be performed by the independent Principal Valuer @ AskTheValuer, a very experienced, skillful and knowledgeable professional who has done numerous such valuations in over 15 years. For more details about the valuer, go to <About>.